Another year is soon coming to an end! You may be considering retirement, but are you emotionally prepared to retire? We discuss five phases to consider when planning your retirement journey!

Taking a goals-based approach to investment risk

Happy New Year! New Year’s resolutions are in full swing. In this article to start off the new year, we address one New Year’s resolution you can implement easily, by reviewing your investment risk. The real measure of risk is whether or not you reach your financial goals. Let’s take a look.

I’m hearing a lot about a CFP lately. What’s with all the noise?

The Certified Financial Planning (CFP®) Board has funded millions of dollars into an aggressive ad campaign over the last couple of years. Let’s find out why and what the big deal is?

The IRS combats refund fraud and identity theft by offering IP PINs

Our network of Certified Public Accounts have informed us that there is a significant rise in fraudulent tax returns being filed. The IRS is combating refund fraud and identity theft. But what should you do to be proactive and protect yourself from being the next victim?

Why now is still a good time for a financial review

It’s funny how quickly we adapt to changing times, isn’t it? The Zoom Revolution is here and video conferencing has reconnected us. Kinda sort of…

Robo-Advisor – Domo arigato, Mr. Roboto!

We’re hearing a lot about Robo-Advisors these days. Are they right for you? Let’s find out;

What Regulation Best Interest (BI) means to you

The Securities and Exchange Commission (SEC) has introduced a new set of rules called Regulation Best Interest (Reg BI), designed to ensure that those who buy and sell securities on behalf of clients do so in their clients’ best interest. So what else does Regulation BI include?

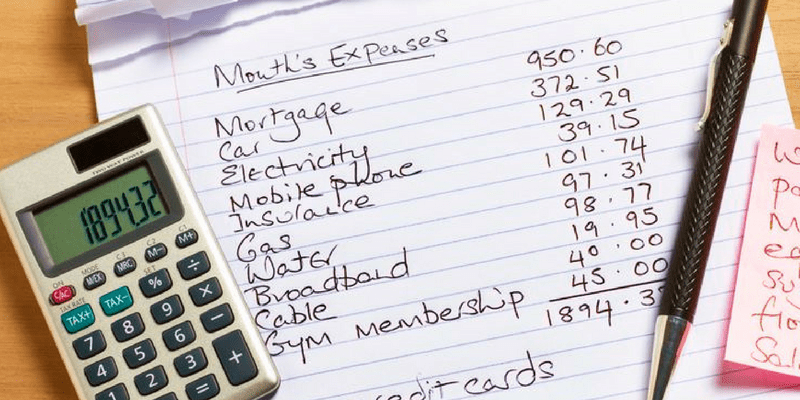

Top Budget Hacks for Planning and Accounting

Something most rags-to-riches stories have in common, is that a good budget is always needed to help anyone achieve financial security. If you want to significantly improve your credit, you have to learn how to pace your spending and increase your savings. So, how would one do that?

Tips for Avoiding an Out of Money Experience

Do you run out of money before you run out of month? Many do, but it doesn’t have to be that way! Here’s why;

True or False? — Does it Take Money to Make Money?

The short answer is YES; of course it takes money to make money, but…