Something most rags-to-riches stories have in common, is that a good budget is always needed to help anyone achieve financial security. If you want to significantly improve your credit, you have to learn how to pace your spending and increase your savings. So, how would one do that?

Top notch advice

There is no better medicine for bad spending, than to see what you have to pay for in the future to live the life that you want. In this article, we’ll offer you some top notch advice on budgeting and accounting:

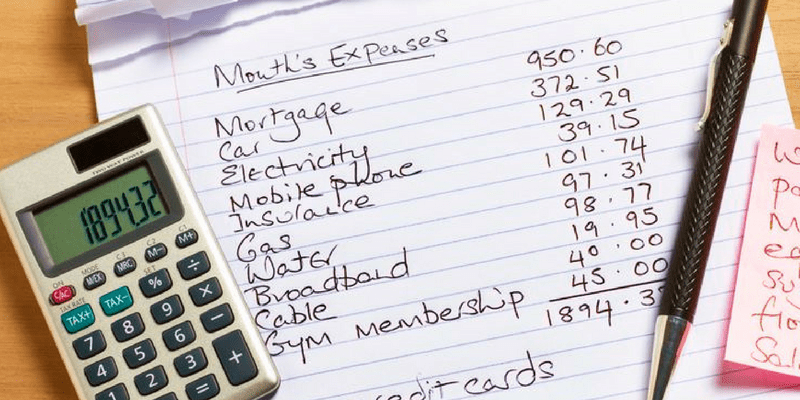

# 1 – Keep Detailed Records

Most people don’t keep track of every little expense they make.

People usually rely on the online banking records to calculate their expenses. This is quite effective when it comes to having a bigger picture, but it doesn’t help you keep an eye on bad expenses and avoidable spending.

Make a folder on your computer, as not to waste paper. You’ll be able to edit easily and write down everything you spend in an ‘expenses’ file, while also keeping track of all incoming money in an ‘income file’.

At the end of each month and each year, you should check how much of your money went to avoidable, ‘bad’ expenses. Cut down on the frivolous spending and watch your savings grow.

#2 – Predict Large Expenses

The number you’ll get will probably shock you, which is a good thing. There is no better medicine for bad spending, than to see what you have to pay for in the future to live the life that you want.

It might sound like an obvious tip, but you’d be surprised how few people actually plan ahead for the major expenses during their lifetime.

Buying a house or paying rent for life is one of those predictable, large expenses. Having a child (or many) is a predictable expense. If you include a few cars, a couple of large trips, furniture, college debts, and similar big expenses, you can have a good look at what kind of money you’ll need to achieve the lifestyle of your dreams.

The number you’ll get will probably shock you, which is a good thing. There is no better medicine for bad spending, than to see what you have to pay for in the future to live the life that you want.

#3 – Make a ‘Get-Rich’ Plan

Expert financial planners would advise anyone who wants to become rich to make a solid plan to achieve that goal.

Riches rarely come to those that simply wait for them. This doesn’t mean that it takes extreme effort to become financially secure either.

What you really need is diligence. Make a plan on your own or get the help of a professional, and learn to stick to it as if it were a religion.

Learning to live with a strict (if not tight) budget, will help you learn to keep frivolous spending in check.

Refer to our previous article discussing Tips for Avoiding an Out of Money Experience.

Bottom line is this: remember that no matter how much money you make, you can easily spend it all on some luxurious stuff you don’t need and end up being poor again. Being truly rich for life means that you have to work for it and keep ahead of the financial game at all times!

—

Posted from Admin at Association Financial Services, LLC